News Corp Australia uses program that manages crawler bot visitors on our Web-sites. If you receive this message and therefore are not a crawler bot (and are merely a reader or subscriber), be sure to try out these measures initially:

Chime provides on-line-only accounts that decrease service fees furthermore, receives a commission as much as two times early with direct deposits

Be sure to Take into account that your lender could connect with, e-mail or textual content you to substantiate mortgage aspects. Responding speedily to them may perhaps accelerate the method for depositing your hard earned money.

There is absolutely no penalty for cashing out a life insurance policy policy, but there may be a surrender charge with regards to the coverage and just how long you might have had it.

Should you take the loan phrases, most lenders will direct you to definitely an e-signature site to finish the loan system. Remember to make an effort to browse your bank loan settlement ahead of accepting and signing it.

E-Signature – Typically called an electronic signature this demands a software which binds your signature or A few other mark to your document. The E-sign Monthly bill was passed by the government in June 2000 which legalizes this signature.

Should you cash out or surrender a everyday living insurance plan policy, you’ll commonly owe taxes around the difference between the cash surrender price and Everything you paid out in rates.

Can I withdraw more than the RMD? Indeed, you are able to normally get out more than the RMD amount of money. Nonetheless, keep in mind that your withdrawal might be taxed as normal profits, and any excess you consider out won't depend toward your RMD volume for future several years.

For most Us residents, that’s about to indicate buying the stock market, whether or not within a 401(k) or at a web-based brokerage. But figuring out exactly how much of your cash To place in stocks is often tricky.

Look into the newest in leisure, with the purple carpet to Middle phase, featuring movie star coverage you'll be able to only get from us.

If you're feeling self-assured your investments can climate the storm, Be at liberty to improve your stock market exposure, which makes it more most likely your cash will previous your total lifetime, with Potentially something remaining over for the heirs. Spero has clientele nicely into their eighties and nineties, and he says they rarely end up having less than thirty% in their portfolios in shares.

If you fall short to produce your complete distribution, the IRS can issue you to a tax penalty of twenty five% of the amount you need to withdraw. If you accurate your blunder inside of two years, the IRS may well reduce the penalty to ten%.

You conform to cooperate entirely with any this sort of investigation. You acknowledge that violations with the Terms of Use or maybe the Privateness Policy may very well be topic to criminal or civil penalties.

Forbes Advisor adheres to more info demanding editorial integrity specifications. To the most beneficial of our expertise, all content is correct as of your date posted, even though presents contained herein might no more be out there.

Haley Joel Osment Then & Now!

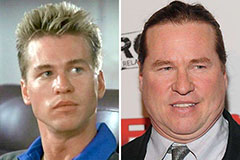

Haley Joel Osment Then & Now! Val Kilmer Then & Now!

Val Kilmer Then & Now! Mason Reese Then & Now!

Mason Reese Then & Now! Tina Louise Then & Now!

Tina Louise Then & Now! Kerri Strug Then & Now!

Kerri Strug Then & Now!